You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock trading

- Thread starter tentoes4rings

- Start date

OK, yield then.Who said anything about prices? The Fed buying bonds has always been about liquidity. Prices are mostly a function of interest rates.

StllH8L8ner

You’ll get nothing and like it!

- Joined

- Mar 22, 2020

- Messages

- 3,149

- Reaction Score

- 17,892

I’ve been buying in my kids’ UTMA accounts here and there. They can’t touch it for 10+ years so I have a nice long runway for Apple, NVDA, Amazon and others.Even if it's two years until it turns around, the perm-bears are still wrong . . .

- Joined

- Aug 26, 2011

- Messages

- 37,171

- Reaction Score

- 38,859

Politics is always first.That's because they're constrained by policy makers.

The answer to overheating economy is not always interest rates. You can do a great many things. If it's too much credit in the system, too much in circulation, congress has the ability to curtail that in ways that don't require huge increases in unemployment. But that's not the world the Fed lives in.

Unfortunately, we are moving to new lows and each time the lows are lower. Be careful my friends. With our dwindling emergency energy reserves, we have less cushion for the likely energy shocks coming this winter. Not the time to be aggressive. First rule of investing, materially protect your principle. There will be better economic environments to make money down the road.

.-.

HuskyHawk

The triumphant return of the Blues Brothers.

- Joined

- Sep 12, 2011

- Messages

- 35,196

- Reaction Score

- 93,395

It's bad. Wish I had more real estate. But that's also bad. My booze may be the only thing that's up.

Now that inflation has been reported. Over-all, 3rd quarter earnings growth has been significantly revised down since July and earnings now will be the short term catalyst. This trend will more likely excelerate downward than stabilize or reverse over the next 2 months.

August_West

Conscience do cost

- Joined

- Aug 29, 2011

- Messages

- 51,441

- Reaction Score

- 90,626

Paulie Walnuts has a special message for anyone playing the stocks this week. Enjoy. Be safe. Make money at the hands of the wealthier if you can.... | By The Grunge Bible | Facebook

Paulie Walnuts has a special message for anyone playing the stocks this week. Enjoy. Be safe. Make money at the hands of the wealthier if you can....

fb.watch

fb.watch

UConnSwag11

Storrs, CT The Mecca

- Joined

- Aug 26, 2011

- Messages

- 14,395

- Reaction Score

- 57,379

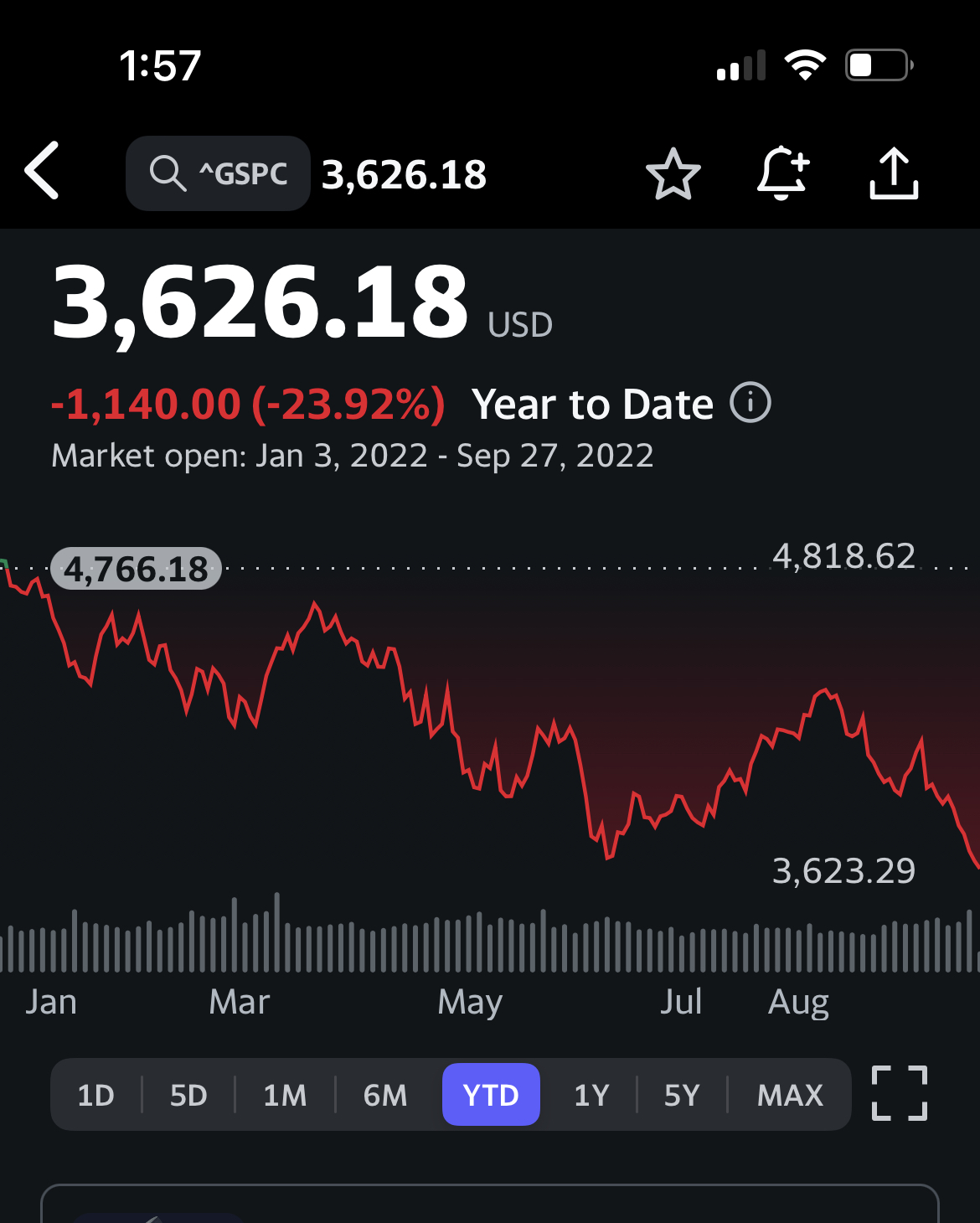

SPX heading sub 3500

About time for a correction. The market has gone almost straight up since 2009. In bought the TZA at (which shorts the Russell) 15 quite a while ago and plan on holding it for the foreseeable future.SPX heading sub 3500

.-.

FedEx is a company that has good visibility into many sectors of the economy. Be careful and cautious for awhile.

FedEx CEO says he expects the economy to enter a ‘worldwide recession’

FedEx CEO says he expects the economy to enter a ‘worldwide recession’

S&P500 down 21% YTD and 120 points before testing new lows for the year. That will likely come during 3rd quarter earnings and forecasts. It is ugly out there, be careful investing for awhile. I do think the next wipeout will be the floor with opportunities.

- Joined

- Aug 26, 2011

- Messages

- 21,610

- Reaction Score

- 51,587

When did you get that at 15?About time for a correction. The market has gone almost straight up since 2009. In bought the TZA at (which shorts the Russell) 15 quite a while ago and plan on holding it for the foreseeable future.

- Joined

- Aug 26, 2011

- Messages

- 9,079

- Reaction Score

- 26,615

Will be buying SCHD and SCHG on each dip

Not a bad idea especially when you have no idea where the bottom is.

A couple years ago which was prior to a reverse split.When did you get that at 15?

.-.

Unfortunately, as I feared, the S&P500 has retested a new low for the year. The lows just keep getting lower as the year progresses. 3Q Earnings are going to be generally brutal, so more pain before gain. Continue to be careful out there. Perhaps, the bond market will eventually turn and lead us into something good, but not for awhile.

- Joined

- Aug 24, 2011

- Messages

- 4,616

- Reaction Score

- 12,875

Stepping onto the soapbox.........

Trying to time the market is fools gold. You may get lucky once in a while, but more often than not you will pay a price. I fear that many who have been on this thread over the last 2-2.5 years and were highly concentrated in crypto, tech and meme stocks on daily trades are in a pretty bad place. History would suggest this is a correction and for those holding steady with the right diversification and liquidity all should be fine.

..........Stepping off of the soapbox

Trying to time the market is fools gold. You may get lucky once in a while, but more often than not you will pay a price. I fear that many who have been on this thread over the last 2-2.5 years and were highly concentrated in crypto, tech and meme stocks on daily trades are in a pretty bad place. History would suggest this is a correction and for those holding steady with the right diversification and liquidity all should be fine.

..........Stepping off of the soapbox

CTBasketball

Former Owner of the Pizza Thread

- Joined

- Aug 27, 2012

- Messages

- 10,732

- Reaction Score

- 39,893

Timing it isn’t really ideal. It’s more of using technical analysis to time when it will pull back or run up.Stepping onto the soapbox.........

Trying to time the market is fools gold. You may get lucky once in a while, but more often than not you will pay a price. I fear that many who have been on this thread over the last 2-2.5 years and were highly concentrated in crypto, tech and meme stocks on daily trades are in a pretty bad place. History would suggest this is a correction and for those holding steady with the right diversification and liquidity all should be fine.

..........Stepping off of the soapbox

And maybe a little current events and what’s going on in the world too.

- Joined

- Aug 24, 2011

- Messages

- 4,616

- Reaction Score

- 12,875

Timing it isn’t really ideal. It’s more of using technical analysis to time when it will pull back or run up.

And maybe a little current events and what’s going on in the world too.

Sorry, but I don't believe you can do it any better than anyone else over the long-term.

August_West

Conscience do cost

- Joined

- Aug 29, 2011

- Messages

- 51,441

- Reaction Score

- 90,626

Id just as soon play craps.

Assumed in your post is a World of absolutes, fully invested /zero invested. Personally, I don’t invest in Crypto because I don’t understand it. However, in the World of stocks, bonds, cash and commodities; I regularly adjust my allocations. Some plays have historically performed better under certain macro conditions. Principles such as don’t fight the Federal Reserve have been proven wise over time. When the money supply was expanded 20% through monetary and fiscal policies, stocks tend to go up in the short run. But then, too many dollars chasing too few goods causes inflation.Stepping onto the soapbox.........

Trying to time the market is fools gold. You may get lucky once in a while, but more often than not you will pay a price. I fear that many who have been on this thread over the last 2-2.5 years and were highly concentrated in crypto, tech and meme stocks on daily trades are in a pretty bad place. History would suggest this is a correction and for those holding steady with the right diversification and liquidity all should be fine.

..........Stepping off of the soapbox

Sure, you stay invested in things you feel won’t do well in the short term because you could be wrong, but perhaps you reduce the allocation to that sector.

For example, Ultilities to me have a current appeal due to dividend income and the longer term public policy to use electric cars. Compared to the major indexes their loses have been relatively modest. The threat is rising bond yields will steer away income investors to bonds and there are legitimate questions about electric car affordability and batteries.

I do agree diversification and having some liquidity to lessen the downside and buy dips once a floor has been established, is wise.

.-.

CTBasketball

Former Owner of the Pizza Thread

- Joined

- Aug 27, 2012

- Messages

- 10,732

- Reaction Score

- 39,893

You can tell when stocks are oversold, undersold, how it’s momentum is. You can key that in with key price levels to get a good idea of when things will re-test resistances or dip down to supports.Sorry, but I don't believe you can do it any better than anyone else over the long-term.