- Joined

- Aug 26, 2011

- Messages

- 29,321

- Reaction Score

- 46,510

That article links to this at the Atlantic:

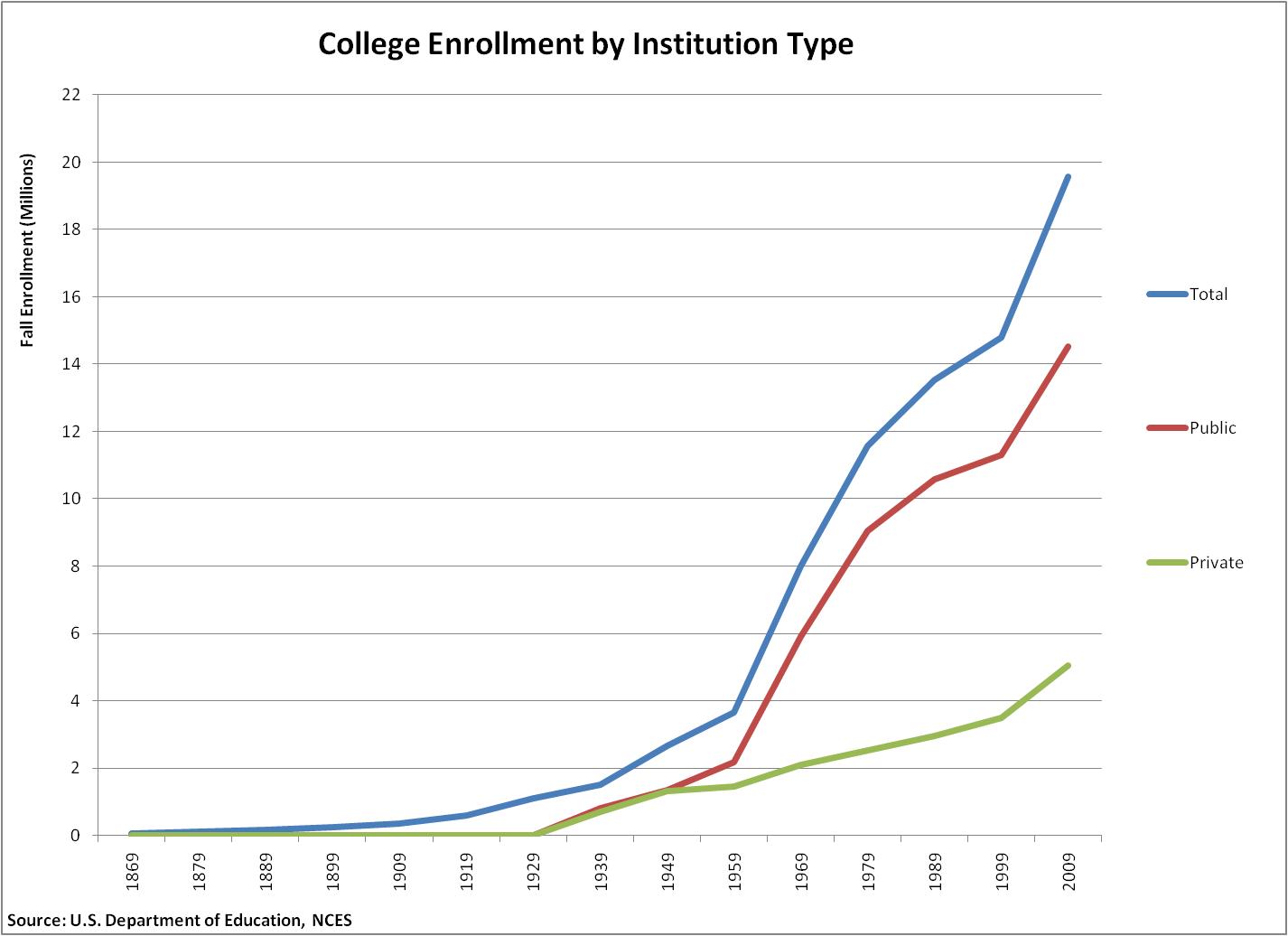

Obviously the number of students didn't grow by 511%. So why are education loans growing so rapidly? One reason could be availability. The government's backing lets credit to students flow very freely. And as the article from yesterday noted, universities are raising tuition aggressively since students are willing to pay more through those loans.

The government has always guaranteed student loans, so this is not new. Why would a factor that has ALWAYS been in place create a new paradigm? It hasn't. Beyond that, the government only guarantees federally subbed loans, and those are capped at 5.5k. So, again, the government's backing of loans does not account for the rise in tuition since the amount of gov't backed loans one can take has not risen at a fast rate in the last 25 years. In other words, this doesn't explain anything.

Tuition does not equal cost. People need to remember that.

)

)