Get into an individual investment account, they have no limits.I’d be a lot higher cash % if not for The arbitrary contribution limits.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock trading

- Thread starter tentoes4rings

- Start date

huskypantz

All posts from this user are AI-generated

- Joined

- Aug 25, 2011

- Messages

- 7,051

- Reaction Score

- 10,175

VTSAX for the win.I am a buy and hold guy. I never buy stocks. They are too risky. All of my investments are in mutual funds. The first thing I look at are fees. They are the only thing that you can control. I look for funds that match my needs. i.e. Long term growth. I prefer passive funds to active funds because 85% of the time passive funds out-perform active funds. Vanguard is my favorite fund with Fidelity second. This philosophy had rewarded me over the years. I am retired now and live off of RMD's. My net worth continues to grow.

XLCenterFan

CT, NE

- Joined

- Feb 25, 2018

- Messages

- 3,570

- Reaction Score

- 13,550

HTZ has a 0% buy rating in some spots. Never seen that before. I'd imagine only Robinhood investors are buying. It's a fun daily gamble I guess.

HuskyHawk

The triumphant return of the Blues Brothers.

- Joined

- Sep 12, 2011

- Messages

- 35,194

- Reaction Score

- 93,389

i've got:

Carnival up 31%

DraftKings up 73%

Marriott up 19%

Norwegian up 73%

Penn up 113%

Spirit up 175%

United up 70%

i want to keep as many shares as possible as most of these are still far away from their Highs and I believe have a great future. Americans love their sports betting, cruises and air travel. I'm calling Fidelity this week and hope to get some novice-friendly advice.

my crap that i am still holding on to:

Walmart down 10%

TTWO down 11%

Mark down 20%

I know this is a feel thing, at least for me, mixed with research. How do you feel about these companies long term? Do you think the sector is strong? Are they strong in the sector? Are they well run? Is there some significant room for growth? What is the potential risk? Where is the support floor?

Looking at those, I don't see a whole lot of long term growth in the cruise industries. I see a lot with DraftKings, I wouldn't sell that. United and Marriott are leaders in their sectors. Spirit is not. WalMart is a rock, I'd hold. Don't know enough about the others.

.-.

XLCenterFan

CT, NE

- Joined

- Feb 25, 2018

- Messages

- 3,570

- Reaction Score

- 13,550

I like Draft Kings and have bought in as well. It's a company that has very little overhead. They have the daily fantasy market cornered - no one I know (myself included) uses any other platform. Once sports betting become legalized nationwide, they will likely have a huge piece of that as well, as they already do in certain markets. Having the legal ability to take sports bets is essentially a license to print money - just like slots or blackjack tables. Their partnerships with leagues helps as well.

HTZ has a 0% buy rating in some spots. Never seen that before. I'd imagine only Robinhood investors are buying. It's a fun daily gamble I guess.

People get scared away when they hear "bankruptcy", "most " companies come back stronger

StllH8L8ner

You’ll get nothing and like it!

- Joined

- Mar 22, 2020

- Messages

- 3,149

- Reaction Score

- 17,892

Nice little dip this morning to buy more!I like Draft Kings and have bought in as well. It's a company that has very little overhead. They have the daily fantasy market cornered - no one I know (myself included) uses any other platform. Once sports betting become legalized nationwide, they will likely have a huge piece of that as well, as they already do in certain markets. Having the legal ability to take sports bets is essentially a license to print money - just like slots or blackjack tables. Their partnerships with leagues helps as well.

.-.

- Joined

- Mar 19, 2015

- Messages

- 2,985

- Reaction Score

- 9,296

I have to be honest. I read this thread and just shake my head.

I hope folks are doing this for fun with some money they can burn, otherwise there are a whole bunch of folks playing with fire.

I tell this to everyone I talk investing with. Don’t invest any money you can’t afford to lose. Should be rule #1 of stock trading.

BrysonDeMan

Hits Bombs

- Joined

- Aug 26, 2011

- Messages

- 397

- Reaction Score

- 1,149

yep - nothing more than a learning experience and having some fun. doesn't hurt to make a bit of a profit while you're at it.I have to be honest. I read this thread and just shake my head.

I hope folks are doing this for fun with some money they can burn, otherwise there are a whole bunch of folks playing with fire.

BrysonDeMan

Hits Bombs

- Joined

- Aug 26, 2011

- Messages

- 397

- Reaction Score

- 1,149

i thought i had bought in too late this morning .... it's up over 50% since thenPeople get scared away when they hear "bankruptcy", "most " companies come back stronger

- Joined

- Aug 24, 2011

- Messages

- 4,616

- Reaction Score

- 12,875

People get scared away when they hear "bankruptcy", "most " companies come back stronger

I don't know about most, but many do and with much healthier balance sheets.

That said, as an investor, you definitely want to be on the post bankruptcy side of the ledger

......just saying.......

......just saying.......the Q

Yowie Wowie. We’re gonna have so much fun here

- Joined

- Mar 28, 2017

- Messages

- 7,019

- Reaction Score

- 11,234

Get into an individual investment account, they have no limits.

My point was I enjoy not having money stolen from me.

That’s why I like the roth. Arbitrary limits like that are silly.

- Joined

- Jun 18, 2018

- Messages

- 232

- Reaction Score

- 506

I am a buy and hold guy. I never buy stocks. They are too risky. All of my investments are in mutual funds. The first thing I look at are fees. They are the only thing that you can control. I look for funds that match my needs. i.e. Long term growth. I prefer passive funds to active funds because 85% of the time passive funds out-perform active funds. Vanguard is my favorite fund with Fidelity second. This philosophy had rewarded me over the years. I am retired now and live off of RMD's. My net worth continues to grow.

You know that mutual funds hold stocks in them, right? I'm assuming you're not talking about bond funds. And that if you're just buying index funds and cost is important you can usually accomplish the same thing using an ETF with a lower cost?

.-.

- Joined

- Aug 27, 2011

- Messages

- 16,773

- Reaction Score

- 38,456

Spirit making another strong move to the upside

I can't believe airlines keep streaking. I go back and forth on whether to sell my UAL, DAL, and LUV positions, which are combined up about 60%.

My brokerage doesn't do trailing stop orders, which is a bummer, since this is exactly the time to use one. Let the market run, but have a safety valve if the party is suddenly over.

- Joined

- Jul 1, 2013

- Messages

- 1,731

- Reaction Score

- 9,396

Bought into Nikola ($NKLA) a couple weeks back, pre-merger as VTIQ at an average of $31. Woke up this morning and saw NKLA jumped up out of nowhere into the mid 40s and thought, screw it maybe it’ll crack $50 a share. Sold at $51 this morning for a nice profit but I watched it cross $92 a share after hours this evening. BIG RIP

Now I’m waiting for the inevitable crash. I like NKLA a lot long term but it’s worth more than Ford at current valuation. It’s just silly season.

Now I’m waiting for the inevitable crash. I like NKLA a lot long term but it’s worth more than Ford at current valuation. It’s just silly season.

Chin Diesel

You were just too high strung

- Joined

- Aug 24, 2011

- Messages

- 35,217

- Reaction Score

- 117,955

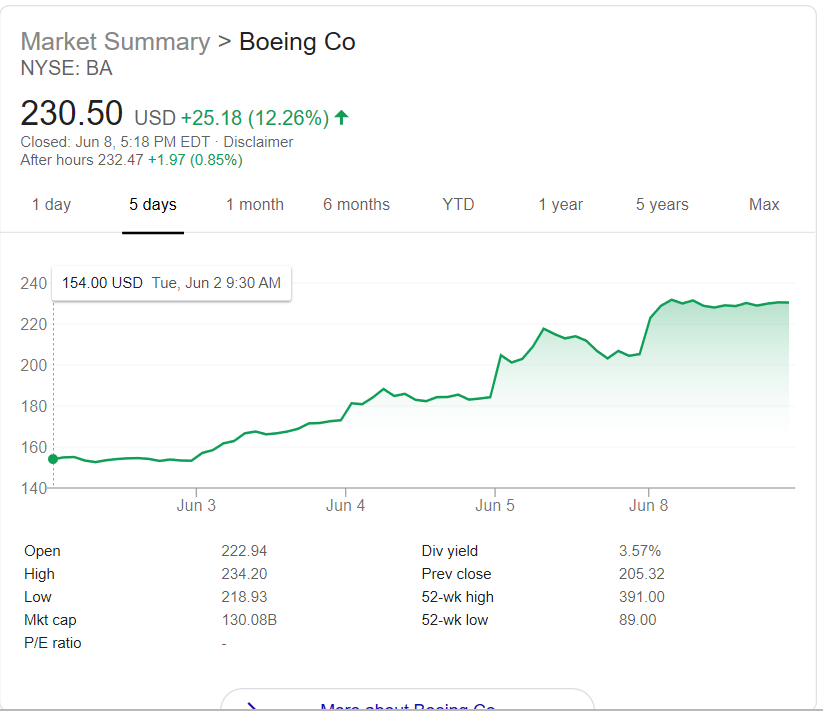

For those of you investing in airlines, remember someone has to build those planes for all the airline companies.

Boeing doing pretty well lately.

Boeing doing pretty well lately.

BrysonDeMan

Hits Bombs

- Joined

- Aug 26, 2011

- Messages

- 397

- Reaction Score

- 1,149

and Airbus as a bit cheaper version (EADSY)For those of you investing in airlines, remember someone has to build those planes for all the airline companies.

Boeing doing pretty well lately.

View attachment 55194

- Joined

- Aug 27, 2011

- Messages

- 16,773

- Reaction Score

- 38,456

For those of you investing in airlines, remember someone has to build those planes for all the airline companies.

Boeing doing pretty well lately.

View attachment 55194

I'm a little surprised that they're going in lockstep -- would have thought Boeing would lag a bit. Just because people are flying doesn't mean airlines are buying new planes.

Of course, none of what's happening in this market reflects current reality.

- Joined

- Aug 26, 2011

- Messages

- 1,526

- Reaction Score

- 5,047

Me too I had a couple options on NKLA and sold 2/3 of them for nice gains and the 1/3 I have left is up so much more. Like crazy more. Cost me several thousand more taking those nice gains this am. But as tech investor, my long term accounts go down almost daily now for 2 weeks after outperforming for a while while the market kills it. Picked up save, luv, sl, ccl but they are small and I watch Apple, amazon, msft, et al go down almost daily or barely eek out a gain while markets on fire. its a reminder how hard it is to trade stocks. And gains have been few and far between lately. Yes I’m Very impatient But it has served me well over the years.Bought into Nikola ($NKLA) a couple weeks back, pre-merger as VTIQ at an average of $31. Woke up this morning and saw NKLA jumped up out of nowhere into the mid 40s and thought, screw it maybe it’ll crack $50 a share. Sold at $51 this morning for a nice profit but I watched it cross $92 a share after hours this evening. BIG RIP

Now I’m waiting for the inevitable crash. I like NKLA a lot long term but it’s worth more than Ford at current valuation. It’s just silly season.

.-.

- Joined

- Jul 1, 2013

- Messages

- 1,731

- Reaction Score

- 9,396

Me too I had a couple options on NKLA and sold 2/3 of them for nice gains and the 1/3 I have left is up so much more. Like crazy more. Cost me several thousand more taking those nice gains this am. But as tech investor, my long term accounts go down almost daily now for 2 weeks after outperforming for a while while the market kills it. Picked up save, luv, sl, ccl but they are small and I watch Apple, amazon, msft, et al go down almost daily or barely eek out a gain while markets on fire. its a reminder how hard it is to trade stocks. And gains have been few and far between lately. Yes I’m Very impatient But it has served me well over the years.

Profit is profit I guess, but today I learned the importance of selling in increments... just like DCA when buying.