- Joined

- Sep 30, 2019

- Messages

- 274

- Reaction Score

- 865

What would everyones contrarian plays be right now, if we could each contribute one?

What would everyones contrarian plays be right now, if we could each contribute one?

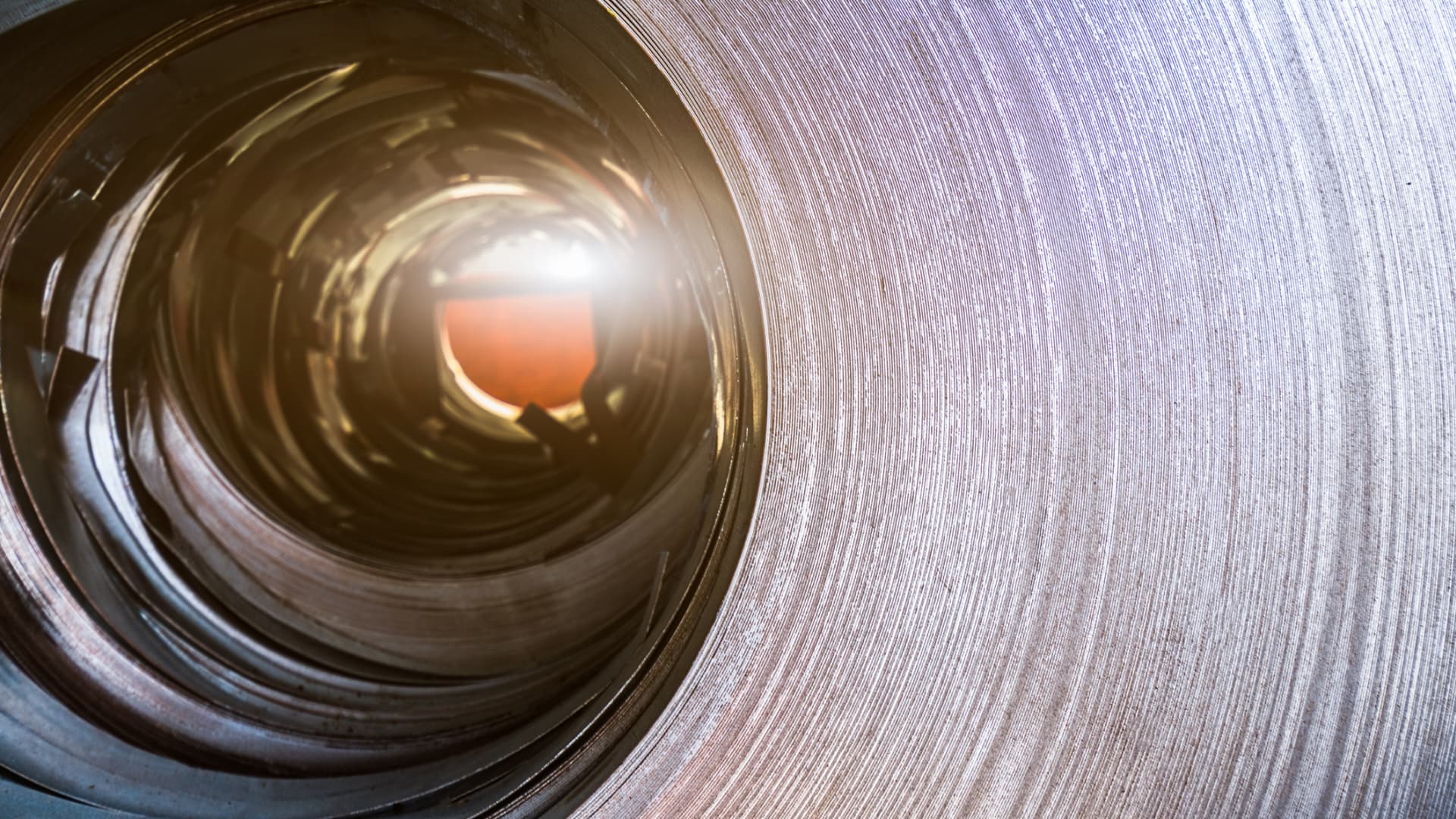

fwiw, the former CEO of Scania is building the first new steel mill in Europe in decades in Sweden near the Arctic Circle. It will be powered by liquid hydrogen.

Sweden will soon be home to a major steel factory powered by the 'world's largest green hydrogen plant'

The iron and steel sector has a significant environmental footprint.www.cnbc.com

What are the pros for crypto long-term? Blockchain technology is here forever and will only continue to improve and impact all aspects of our lives.

What would be the reason crypto fails long-term? Meteor hits Earth. Honestly, I don’t see all of crypto failing but majority of the current token/projects won’t survive. Would suggest doing your homework and exploring crypto that offers utilization/purpose

I give you and the marines credit, I’ve lost hope in this project. Focused more on MATIC, AVAX, SOL, ETH. Everyone talks about LINK’s massive potential but 53 to 19 while plenty of others made ATHs seems to be a bit of a red flag. It’s almost the same price as it was in July, 2020.

Bumping this. 2022 is here. Thoughts heading into the new year?

I agree that 2022 looks to be very volatile, will probably be a trader’s Paradise. Im focusing on companies that are profitable with very reasonable multiples. Many high multiple stocks have been cut down to much fairer levels but there’s still a lot of risk in this market for companies with flimsy fundamentals.On the Crypto front I asked Balaji what to read and he suggested this. So I did. https://messari.io/pdf/messari-report-crypto-theses-for-2022.pdf

on the stock front, I honestly think 2022 is shaping up to be potentially pretty wild. Lots of volatility. So my only thought is to avoid individual stocks unless you feel really good about the long term.

Dividend companies and ETF's are what im looking at. As well as carbon credits and UraniumDoing what I've done for the last 20 years. Boring Vanguard mutual funds through dollar cost averaging each month. Worked so far!

Wisdom!Doing what I've done for the last 20 years. Boring Vanguard mutual funds through dollar cost averaging each month. Worked so far!

Alternatively, lower-fee ETFs via Vanguard or similar competitors. Here, 90/10 ETFs (few lingering mutual funds)/self-managed securities, cuz' boring's not bad!Doing what I've done for the last 20 years. Boring Vanguard mutual funds through dollar cost averaging each month. Worked so far!

All roads always lead back to Chainlink.Agree that blockchain platforms like you mentioned above are the best investments in crypto right now. Eventually projects that allow for interoperability across blockchains as well as oracles will have their day in the sun too.

I see LINK as a really safe bet with huge potential down the road. They completely dominate their space as oracles that allow blockchains to use real world data and aren’t going anywhere. Some of the platforms will eventually fall off and Chainlink is involved in virtually every one so you’re safe almost no matter what.

LINK price at make-or-break point as Chainlink aims to secure $2.27 trillion crypto economy

This as well. Couldn't agree more. I made my New Year's investing plans early this year and put them into motion around Thanksgiving.Dividend companies and ETF's are what im looking at.

What’s a great ETF for semiconductors? I want more broad exposure to this industry.

What’s a great ETF for semiconductors? I want more broad exposure to this industry.

SMHWhat’s a great ETF for semiconductors? I want more broad exposure to this industry.

I'm just hanging on INTC LT; flat now, & continue hoping Gelsinger pulls it off. In general, western world must manufacture more outside at-risk Taiwan and its' west TW mainlandI will admit here I’m long Intel. I like Pat Gelsinger, who was good at EMC and then great at VMW. Have listened too him often enough to consider him very forward looking. He is ex Intel and came back to fix it. It’s not an easy fix, and he is making big long term changes. Market of course, focuses on near term and punishes the stock. But I expect Intel to bring a lot of capacity online, including US and European manufacturing. They will also catch up on performance. I think the stock is a bargain.