BABA & BILI. They were both up 5% Tuesday when just about everything else in my watchlist was down. Both were getting hit harder than everything else the days proceeding, because of the scare with the DIDI situation, then Tuesday the global trade news came out. Also, I'm sure you've been watching the shipping bottleneck in the south that is freeing up.

China spent months clipping the wings of some of its tech champions over concerns that they were crowding out the competition. Now Beijing is seizing on data privacy as the next step in a sweeping campaign that threatens to cut companies off from global investment.

www.cnn.com

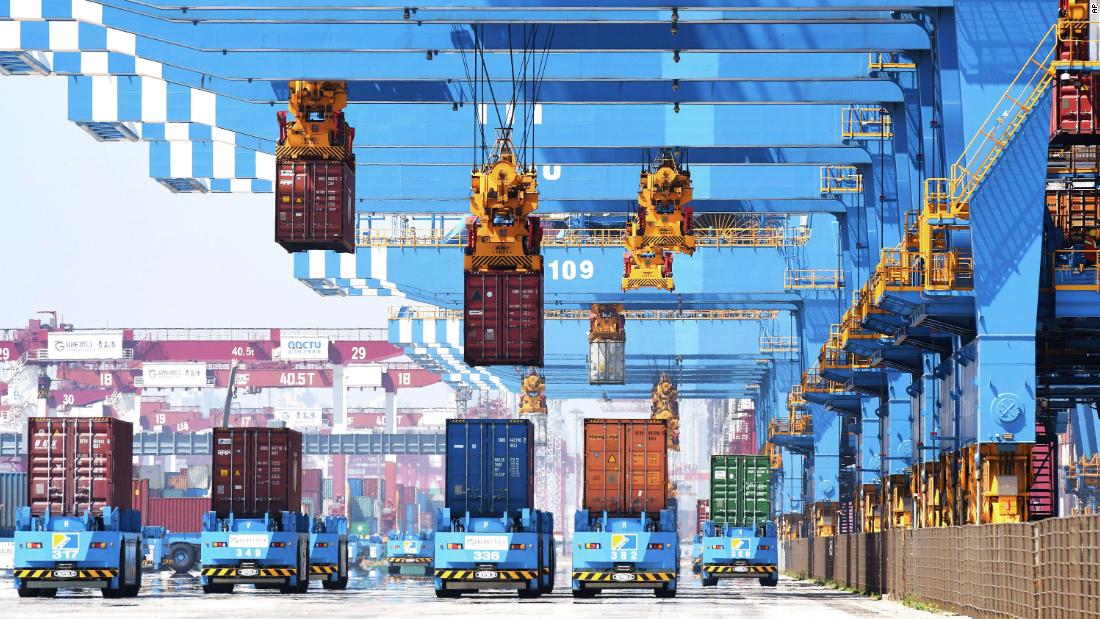

Demand for Chinese-made goods is soaring as the world continues to bounce back from the pandemic. That's helping to calm fears about the recovery in the second largest economy.

www.cnn.com

Amazon & MELI have been thriving the last couple weeks, BABA was struggling the same time.

Ah, so the ole 2 companies symbolically representing

all of a specific "market". Just bustin' 'em, and only my individual pet peeve when others (not you) reference "the market" did X, or the "the markets" are down/up/traded sideways when ALL did not do X or only some parts of ALL equities traded down, or were up, or traded sideways.

All joking aside, clearly non-mainlanders, particularly Yanks, may consider treading lightly with

some mainland-listed companies,

some mainland-specific companies trading in NY, London, or as ADRs in HK, etc. Non-specific, not ALL mainland companies yet

some ETFs or

some non-mainland companies (US, European, JP, KR, TW, etc) active on the mainland

may increasingly become more popular ways to potentially benefit from possible ongoing growth in the Middle Kingdom (China).

Related Barrons article:

Some China Stocks Could Vanish in the U.S. What to Know.